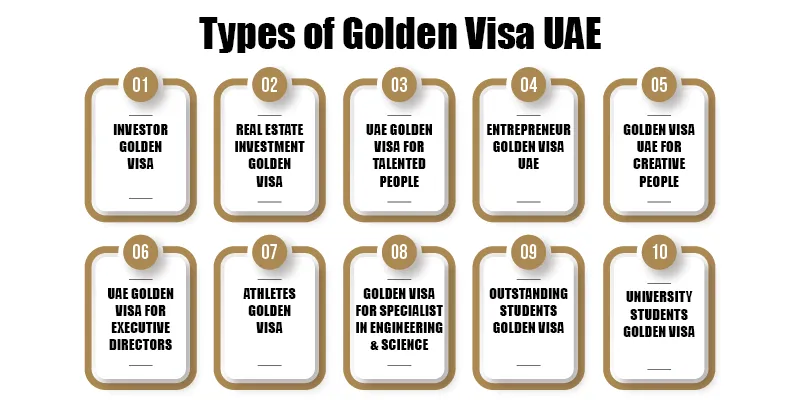

The Golden Visa is a long-term residency visa introduced by the UAE government in 2019. Golden Visa allows foreign investors, company owners, competent professionals, and brilliant students to live, work, invest, study, and do business in the UAE.

This program allows entrepreneurs to protect their future with long-term residency and grow businesses in this dynamic business market. Most people want to know if they can do business in the UAE with a Golden Visa.

The Golden visa was designed for entrepreneurs and business owners with many opportunities for their bright future due to the UAE’s versatile business environment, tax exemptions, and access to world-class infrastructure.

This article examines the possibility of doing business in the UAE having a Golden Visa, including eligibility criteria, benefits, and strategies for using this visa to assist entrepreneur efforts.

Golden Visa Holders Can Start Business In UAE:

Golden Visa holders can do business in the UAE legally. Golden Visa encourages investment and entrepreneurship by removing the need for a local sponsor in many businesses.

It allows people to invest in the UAE and establish and manage enterprises without the usual limitations that apply to non-residents. You can also sponsor colleagues, family members, and domestic help to boost your business ventures.

The Golden Visa allows you to:

- Start a new business in the UAE.

- Buy an existing business.

- Become a shareholder or partner in a UAE-based company.

Types of Businesses Allowed Under Golden Visa:

The Golden Visa allows people to do different business activities in the UAE. The following are some business options available to Golden Visa holders:

Setting up a Free Zone Company:

The UAE free zones provide top-notch opportunities for foreign business. With a Golden Visa, you can start a business in a UAE-free zone area with 100% foreign ownership, tax benefits, and simpler earnings repatriation. Free zone companies are best for professional services, IT, e-commerce, and import-export.

Mainland Company Setup:

Golden Visa holders can start a mainland business, giving them more access to the UAE’s markets. You can run a business and accept government contracts in the United Arab Emirates with mainland enterprises. Golden Visa laws allow foreign investors to possess 100% of the company.

Consultancy and Professional Services:

The UAE is the best place to start a business of professional and consultancy services. Many Golden Visa holders are starting consultancy companies in many fields like marketing, IT, health technology, finance, e-commerce, and legal services.

With the UAE’s constantly growing technology, modern infrastructure and tax incentives, the Golden Visa can assist you expand your firm globally.

Real Estate Investment:

The UAE real estate sector is another attractive opportunity for Golden Visa holders. You can buy and own commercial or residential real estate and start your own real estate business. The Golden Visa requires an investment of AED 2 million in the UAE property.

Franchise Company:

People with a Golden Visa can also invest in well-known franchise units like education, healthcare, and food and beverage.

Eligibility Requirements for Business Owners:

To qualify for the Business Golden Visa, you need to fulfill one of the following criteria:

- Investing in the UAE real estate market requires a minimum of AED 2 million.

- Invest a minimum of AED 2 million in an existing firm or start a new company with at least AED 2 million in capital.

- Entrepreneurs can get the Golden Visa UAE by paying the government AED 250,000 in VAT annually.

- Your project has to be accepted by appropriate authorities or authorized by a certified business incubator.

Steps to Start Your Business on a Golden Visa:

- Choose Your Business Activity: Identify the nature of your business (consulting, e-commerce, real estate, etc.) and make sure it complies with UAE Golden visa rules and regulations.

- Select a Jurisdiction: Choose between a free zone (which offers 100% ownership and corporate tax benefits) and the mainland (which provides broader market access with 100 % ownership) for your business establishment.

- Register Your Business Name: Select a unique business name and register it with the relevant free zone, mainland authorities or the DED department (Department of Economic Development).

- Apply for a Trade License: Get your trade license and submit the required paperwork properly to do business in the UAE.

- Open a Corporate Bank Account: Create a business account in UAE-based bank to handle transactions.

- Obtain Necessary Approvals and Permits: Obtain any extra professional licenses or permits necessary for your industry.

- Hire Staff and Apply for Employee Visas: Recruit staff members and sponsor their visas using your Golden Visa benefits.

- Start-Up and Promote Your Company: Start business operations and use the UAE’s business-friendly climate to develop and flourish.

Tax Implications for Golden Visa Entrepreneurs:

The tax system in the UAE is quite attractive to entrepreneurs. A few important things to remember are:

- No Personal Income Tax: Individuals living in the UAE, even Golden Visa holders, are not required to pay income tax on their personal earnings.

- Corporate Tax: The UAE has a tax-friendly environment with only 9% corporate tax, and no capital gains or inheritance taxes.

- VAT: The UAE levies a 5% VAT on products and services, for which enterprises must register if they exceed the threshold.

The tax laws of the UAE are generally beneficial to businesses, especially in free zones & the mainland, where certain sectors are frequently banned from paying taxes.

Benefits of Doing Business on a Golden Visa:

The Golden Visa provides many benefits to business owners. Some of the them are:

- 100% business ownership: Golden Visa holders can control their businesses completely, eliminating the requirement for a local sponsor.

- Long-Term Stability: Investors and businesses can make long-term business plans with the security provided by the 10-year residence period.

- Freedom to Operate Across the UAE: Golden Visa holders can work anywhere in the United Arab Emirates, even getting government contracts, because of mainland companies.

- Access to UAE’s World-Class Infrastructure: Entrepreneurs with golden visas benefit from the UAE’s outstanding business infrastructure, which includes transportation networks, modern work environments, and digital services.

- Sponsorship: Golden Visa holders can sponsor their family members, parents, household workers, and company employees.

- Multiple Entry Benefits: Golden visa allows you to travel freely in the UAE while being a UAE resident.

Conclusion:

The UAE Golden Visa promotes business ventures in one of the most active economies in the world. The Golden Visa gives you the freedom and flexibility to follow your entrepreneurial goals, whether you want to launch an e-commerce firm, a mainland corporation, or a free zone enterprise.

Even if there are challenges, careful market research, adherence to regulations, and strategic planning may put you in a successful position. Thanks to the strategically located infrastructure available in the UAE and the tax incentives offered, now is a good time to conduct business investment activities on a Golden Visa.

If you are thinking about applying for a Golden Visa or looking for business opportunities in the UAE, then Golden Visa Uae is here to help you with the process. Get in touch with us today to know how we can help you take full advantage of your business activities in the UAE.